Economic Update - April, 2020

posted on Fri, Apr 17, 2020

A lot has changed in the past 6 weeks, since my last economic update newsletter. As a result of the COVID-19 driven global economic shutdown, we are now in the correction quadrant of the economic market cycle (better known as a recession). There is no need to focus on the inverted yield curve and FRED Smoothed recession probability statistics for now. Those tools are used to help predict when the next recession will occur. Once we are clearly out of this current recession, I will add those data points back to the newsletter.

We will keep our focus on the Economic Baseline PI chart to help determine when we start to enter the next phase of the market cycle. Here is the updated analysis.

Economic PI Baseline

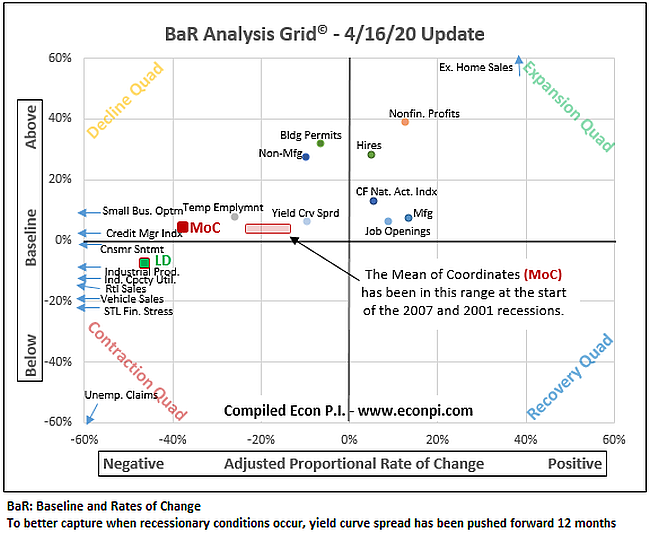

By plotting 19 key economic indicators, the BaR Analysis Grid© clarifies current economic conditions and signals how near the economy is to a recession. The mean of coordinates (MoC) is the average of all plotted points. It indicates the overall health of the economy.

There is a lot of data illustrated on the chart. As April 16, 2020, the MoC (average of all the data points) is right where the start of a recession would be. You will also notice that a lot of the data points are literally off the chart. That is due to the large uncertainty of how long this economic shutdown will last and what lasting damage it will cause.

Now that we know we are in a recession, our focus will be on when we are through the recession and start to enter the early recovery phase of the market cycle. I believe the earliest we can start thinking about that next phase would be a year from now, when we have an effective vaccine to combat future cases of COVID-19.

Investment Strategies

Every recession is different, but there are few general strategies you should always have in place:

- Make sure any equities you hold are good quality and have strong cash positions. In addition, look at equity holdings in the defensive sectors (healthcare, utilities and consumer staples).

- Use this as a time to re-balance your portfolio. It will give you an opportunity to purchase equities at a discount.

- Evaluate your overall risk tolerance. Once we are through this recession then consider adjusting your overall asset allocation to be in line with any changes to your risk tolerance.

- Don’t panic. This may feel different, but the stock market is following the same play book of every other crash and recession. We had an initial shock, it recovered more than half of the initial shock and now we are in a discovery period. The stock market will now try to find the top and bottom for an extended period of time. Eventually, during one of the times it is trying to discover the top, we will start to work through the recession and it will continue its upward trend. The key now is to make micro adjustments.

For this specific recession I would be focused on equity positions that, in addition to having strong cash positions, will also be able to take advantage of the new standards for living (social distancing, work from home, etc.).

Please feel free to contact me anytime to discuss your personal situation in more detail.